THE CASH CODE

〰️

THE CASH CODE 〰️

What's Inside the Curriculum?

Connection between personal finance and financial literacy curriculum and social and emotional learning principles including self-management, responsible decision-making, relationship building, social awareness, and self-awareness.

Creation of engaging informational text passages, reading comprehension questions, and constructed responses aligned with the core text

Development of engaging, real-world-focused activities that explore the following: entrepreneurship, wealth building, and personal finance concepts.

Development of research-focused activities to encourage students to think critically about financial literacy, personal finance, and SEL.

Modules will include the following format: Informational text and video submission that introduce personal finance or financial literacy components and connect the students with Caden.

Alignment with a key social and emotional learning concept. Informational reading passages, constructed responses, and comprehension questions aligned to the module topic.

Standards alignment for reading informational, key vocabulary, narrative writing, informational writing, and narrative writing concepts.

Opportunities for students to implement what they learned in the module in real-world scenarios.

Add the Bus to Your Local Visit

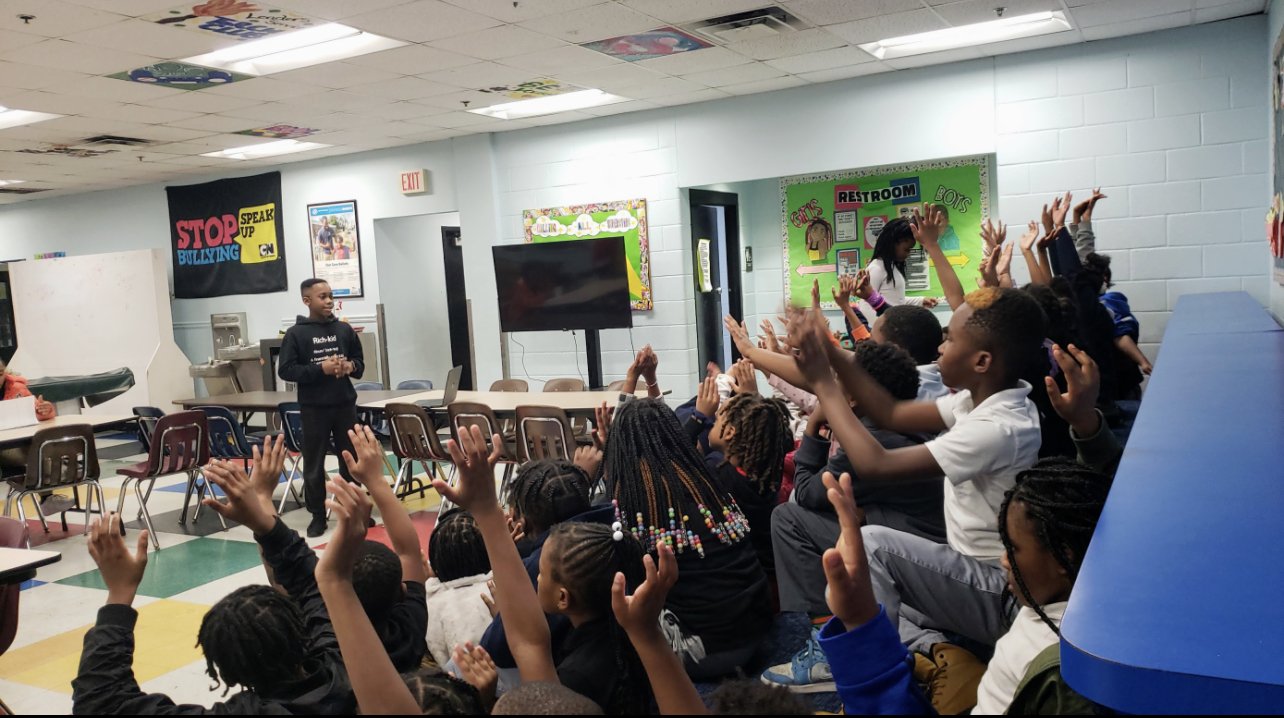

We're excited to offer an exclusive opportunity to enhance your financial literacy curriculum with a unique and immersive experience—Caden's Financial Bus! If you're within a 30-mile radius of Atlanta, GA, here's how you can bring this exciting addition to your educational program:

Key Features of Caden's Financial Bus:

Mobile Learning Hub:Caden's Financial Bus is a mobile learning hub equipped with engaging materials, interactive displays, and hands-on activities designed to make financial literacy fun and accessible.

Live Demonstrations

Educational Games

Interactive Workshops

Contact us to express your interest and check availability. We're here to discuss how Caden's Financial Bus can complement your existing curriculum.

Let's embark on this exciting journey to make financial literacy an unforgettable experience for your students!

Want to sponsor a school?

We have developed a comprehensive financial literacy curriculum aimed at empowering young students with essential financial skills. Recognizing the importance of equipping underserved schools with resources to promote financial education.

Benefits of Sponsorship:

Tax Write-Off: By sponsoring the financial literacy curriculum for a school you can qualify for a tax write-off. This contribution can be considered a charitable donation, allowing corporations to maximize tax benefits while supporting a worthy cause.

Enhanced Social Responsibility: Our partnership will demonstrate commitment to corporate social responsibility. By investing in the financial education of underserved students, we can make a tangible difference in their lives and contribute to building a more financially literate society.